Portfolio Management

We can help you develop your own investment and portfolio strategy, helping you decide which underlying products to invest in and how much risk to include in your portfolio.

We can help you develop your own investment and portfolio strategy, helping you decide which underlying products to invest in and how much risk to include in your portfolio.

What is Portfolio Management

Each of our clients have different investments needs for their wealth. Some need to generate a consistent and high level of income to meet their living expenses during retirement while ensuring their savings have longevity. Others need to generate a high level of capital growth while having some downside protection during volatile markets. Portfolio management is a complex process that is exclusively aimed at achieving these types of investment needs.

Our approach begins with understanding your investment priorities and what is important to you. Such as the relationship between your risk tolerance and your needs in retirement. This is important because it allows us to understand how much portfolio risk you can tolerate and estimate how much wealth you’ll have when you enter retirement.

Once we understand all your priorities, through a dynamic process we model multiple portfolio scenarios and select the portfolio that best fits your needs. Your priorities may include: strategic asset allocation – tolerance for risk, type of quality investments, fee budget, tax strategies, contribution to overall portfolio risk by an individual security, intelligent diversification (not overdiversification), existing debt, existing investment portfolios, investment time horizon, readily cash needs and income and capital growth.

It is important to understand the implications of market disruptions and recessions on various investments. As such we overlay the process with our view on domestic and global economies and markets. When we understand these market forces, we can implement the necessary protection and preserve our client’s capital in volatile markets.

As Stanley Drunkenmiller remarked in an interview in 1992:

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong”.

Portfolio Management Process – Client Centric

Australian Shares Strategy

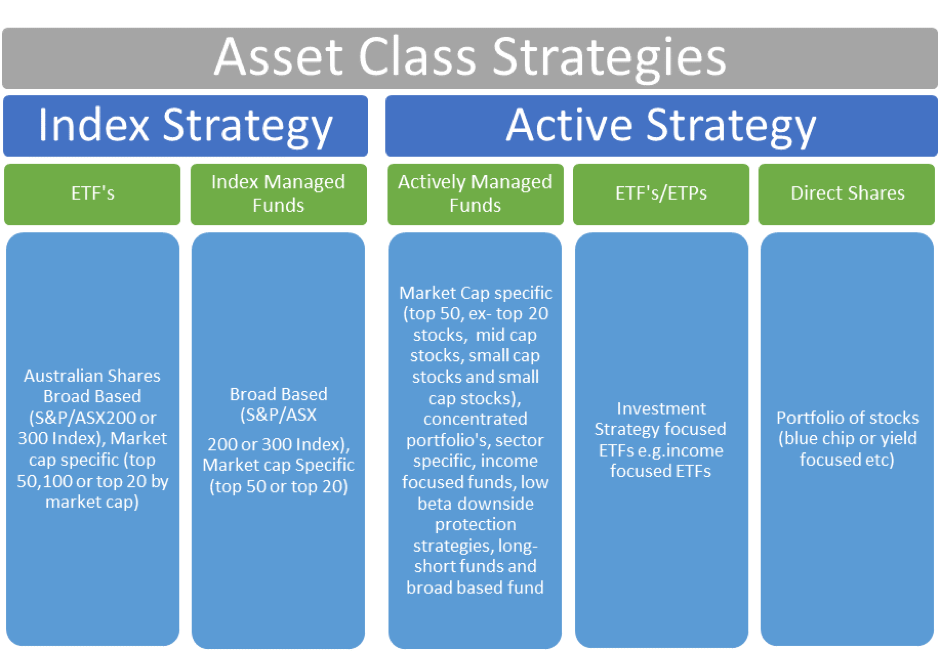

There are number of different investment strategies you may need to implement through your Australian shares component of your portfolio. We will determine what this strategy is and what type of investment products best fit each strategy.

Different type of Investment Strategies

1. Maximize total return

In this case your primary objective may be to generate a high level of total return and volatility, comprising mostly of capital growth and little need for investment income. This may typically apply to accumulator clients.

2. Total return with an income focus

In this case your primary objective may be to generate an overall medium level of capital growth with a secondary objective to provide a consistent level of investment income with franking credits. The investment income focus may be aimed at providing an adequate level of investment income in retirement and prevent you from drawing down on your capital. This may typically be aimed at clients that are transitioning into retirement or already in retirement.

3. Total return with an income focus and downside protection

In this case your aim may be similar to the objectives in two above with the additional aim of seeking investments that out-perform during volatile and falling markets. Aversion to negative returns is typical of retirees and pre-retirees and investing in assets that perform better in downward markets can be a strategy to address sequencing risk and investment risk in retirement.

Once you have determined the objective outcome you want to achieve from your Australian share portfolio, then you need to consider the type of investment product(s) that will be included in your Australian share portfolio. Some of the investment options can be shown in the diagram below.

The investment products are blended (weighting of each investment in the portfolio) based on the following:

- Client’s investment objective – income, capital growth, downside protection or a blend

- Time horizon

- Asset class strategy

- How the Australian share component blends with other investments in the portfolio (International shares, credit, bonds, property, alternative assets and cash)

- Client’s fee budget

- How much each investment contributes to the overall risk of the portfolio

- Is there sufficient level of diversification benefits introduced into the portfolio by each investment? While ensuring not to over diversify the portfolio and erode performance

- Outlook on global and domestic investment markets and economies

A number of scenarios will be modelled, and the optimal portfolios will be selected for discussion.

Once you understand the trade-offs and investments to be included in your portfolio we can implement your portfolio strategy and weighting of the individual investments in your portfolio.

-

"LFMA have been advising me on all aspects of my financial matters for over 10 years now. The strategic questions LFMA had to deal with could be described as rather complex due to my places of taxation being located on two continents. LFMA is regularly getting involved in discussions with my accountant as well. All this communication has always worked flawlessly and I am also more than happy to recommend LFMA as very capable and trustworthy advisors."

Partner with Logical

Simply complete the form below and a member of our team will get in touch within 24 hours.